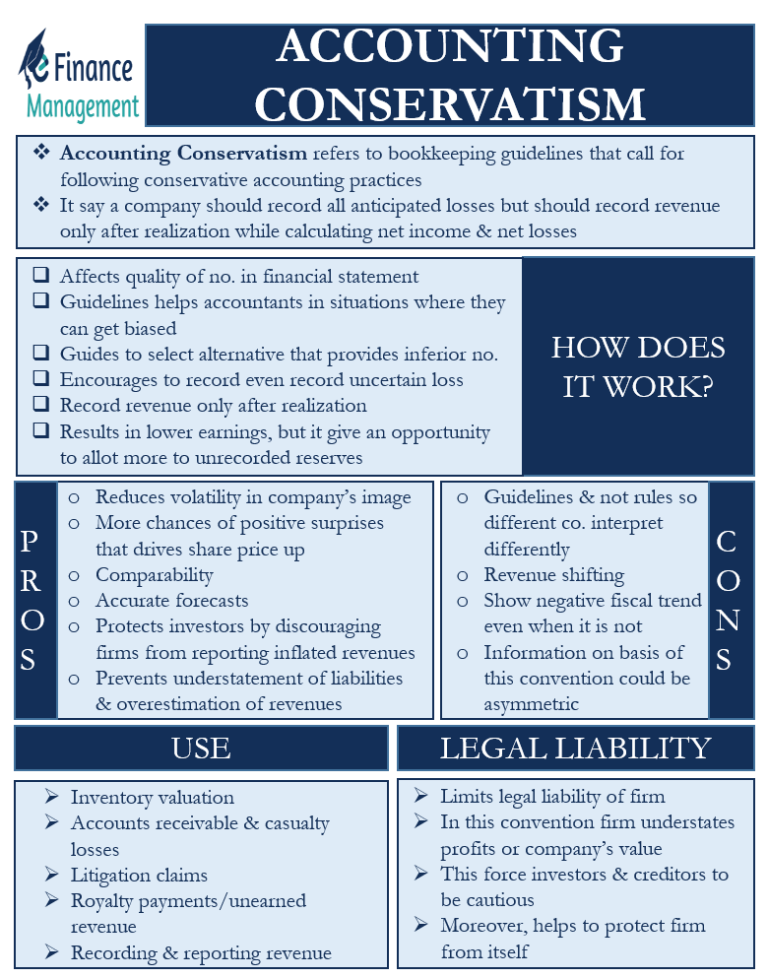

In the conservatism accounting principle, revenue and expenses both need to be realized. If they’re not realized, you can’t record them on your income statement or balance sheet. If you make a transaction that doesn’t result in a monetary exchange, intro to bookkeeping and special purpose journals revenue doesn’t get recognized. So if there is no specific dollar amount exchanged then it doesn’t get recorded. The principle of Conservatism is mostly concerned with the reliability of the financial statements of a business entity.

Impact of Conservatism Principle on Financial Statements

For example, a possible loss from a lawsuit must be reported as a contingent loss, while a possible gain from a lawsuit cannot be reported until a favorable lawsuit ruling has been issued and the related cash has been received. The Conservatism Principle is an accounting principle that suggests accountants should adopt a cautious approach when there are uncertainties or alternative courses of action. In financial reporting, this principle guides the accountant to choose methods that are less likely to overstate assets and income and more likely to understate them. It’s rooted in the idea of playing it safe and being conservative in financial reporting to avoid overestimating the financial health or performance of a company.

Importance/advantages of prudence concept

Conservatism principle is the accounting principle that concern with the reliability of Financial Statements of an entity. The conservatism principle provides guidance to accountants on how to records and recognizes the uncertainty outcome of revenues, expenses, assets, and liabilities in financial statements. Following the conservative approach, companies can only claim profit when it’s fully realized and legally verified. A company should factor in the potential worst-case scenario when making financial forecasts under these guidelines. For example, if there are two options to choose from, the accountant should choose the one with lower numbers to stay on the safe side. While uncertain liabilities would be recorded upon discovery, revenues can only be recorded upon assurance of receipt.

Choose your cookie preferences

Uncertain liabilities are to be recognized as soon as they are discovered. In contrast, revenues can only be recorded when they are assured of being received. The prudence principle of accounting, also known as the conservatism principle, states that a business should exercise a good degree of caution when booking incomes and expenses. If a company can’t report a transaction because it hasn’t yet been legally verified, it might have to be pushed into the following accounting period.

What Does Accounting Conservatism Provide?

Doing so tanks the reported results in the current period, but creates a large reserve against which management can dump any number of losses in later periods. The outcome is a services of overstated financial statements in later reporting periods. Approaching your financial statements using conservatism accounting ensures that they’re prepared with caution. The aim of this concept is to protect investors from potentially inflated revenues and assets. The main goal of this approach is to show accurate revenues and assets. You’re going to overstate losses and understate the recognition of profits.

- An example of when you might use conservatism accounting is with inventory.

- It means one has to record uncertain losses while staying away from recording uncertain gains.

- Basically, uncertain liabilities are going to get recorded once they’re discovered.

- The goal is to help protect investors from revenues and assets that might be inflated.

- It’s tempting to want to make your client’s financial records look as great as possible.

The conservatism principle of accounting states that the accountants must choose the most conservative outcome when two outcomes are available. The main logic behind this principle of conservatism is that when two reasonable possibilities for recording a transaction are available, one must err on the conservative side. It means one has to record uncertain losses while staying away from recording uncertain gains. So when the conservatism principle of accounting is followed, a lower asset amount is recorded on the balance sheet, and lower net income is recorded on the income statement. So, adhering to this principle will record lower profits in the statements.

Another situation when you might use conservatism accounting is when you’re valuing inventory. Using the conservative method, the lower historical cost would be recorded as monetary value. You’d also use this concept when estimating casualty losses or uncollectable account receivables, along with any time you expect to win gains but don’t yet know the specific amount. Conservatism Principle is a concept in accounting under GAAP that recognizes and records expenses and liabilities- uncertain, as soon as possible but recognizes revenues and assets when they are assured of being received.

This is used as guidance when there’s a need for estimation in accounting, preventing inflated figures or bias. Accounting conservatism is the concept that a business should take the most conservative view to recording business transactions. Doing so reduces the risk that transactions entered into an accounting system will need to be adjusted at a later date. This means that expenses and liabilities are recorded as soon as possible, while revenues and assets are recorded only when there is significant assurance of their receipt. Generally accepted accounting principles (GAAP) insist on a number of accounting conventions being followed to ensure that companies report their financials as accurately as possible. One of these principles, conservatism, requires accountants to show caution, opting for solutions that reflect least favorably on a company’s bottom line in situations of uncertainty.